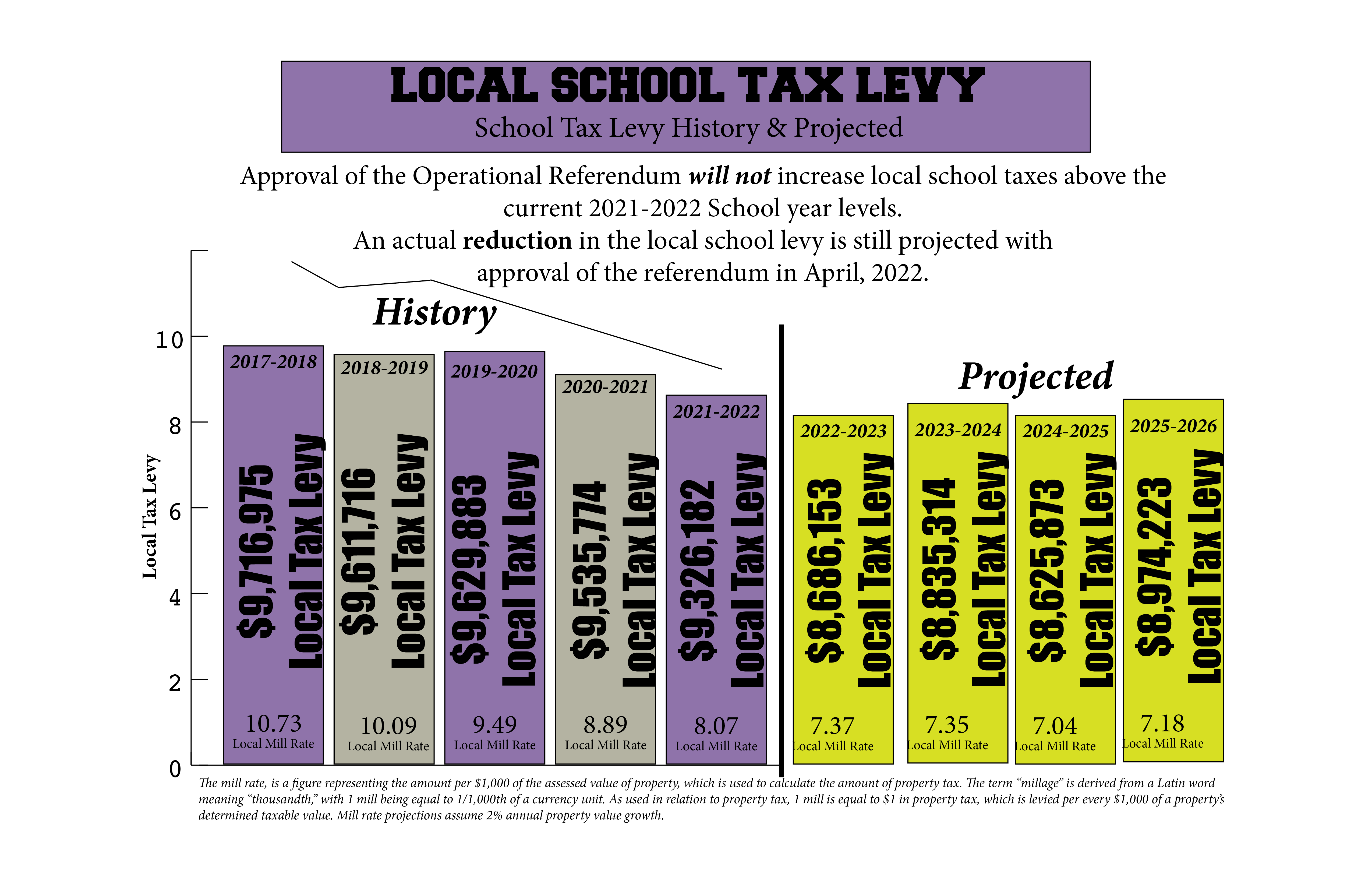

Tax Impact:

If the current Operational Referendum is approved by taxpayers, the local school district tax levy will not increase from the current 2021-2022 school levy. The local school tax levy will actually drop due to a combination of state and local budget factors.

The projected decrease in the local school tax levy and mill rate continues a downward trend we have seen over the past five years. This decrease was projected at the time in which the Ellsworth Elementary School was approved by voters. There are many reasons for this decrease that include budgetary elements at the state level focused on reducing local property taxes and local budgetary factors such as student populations and the expiration of debt for the school district.

The bar graphs located at the right provide a snapshot of the local school tax levy and mill rates for the last five years and the projected levies and mill rates for the four years of the proposed referendum.

How are Referendum Dollars Spent?

As stated above, Operational Referendum dollars provide funding for annual school district operations that include educational programming along with investments in technology, transportation, and facilities maintenance.

The referendum dollars that have been approved by local taxpayers in the past have allowed the District to maintain lower class sizes, improved curriculum, and quality staffing while also providing for technological improvements, an updated student transportation fleet, and ongoing building maintenance.

Without referendum dollars, the district simply would not be able to provide many ongoing investments while basically “kicking the can down the road”.

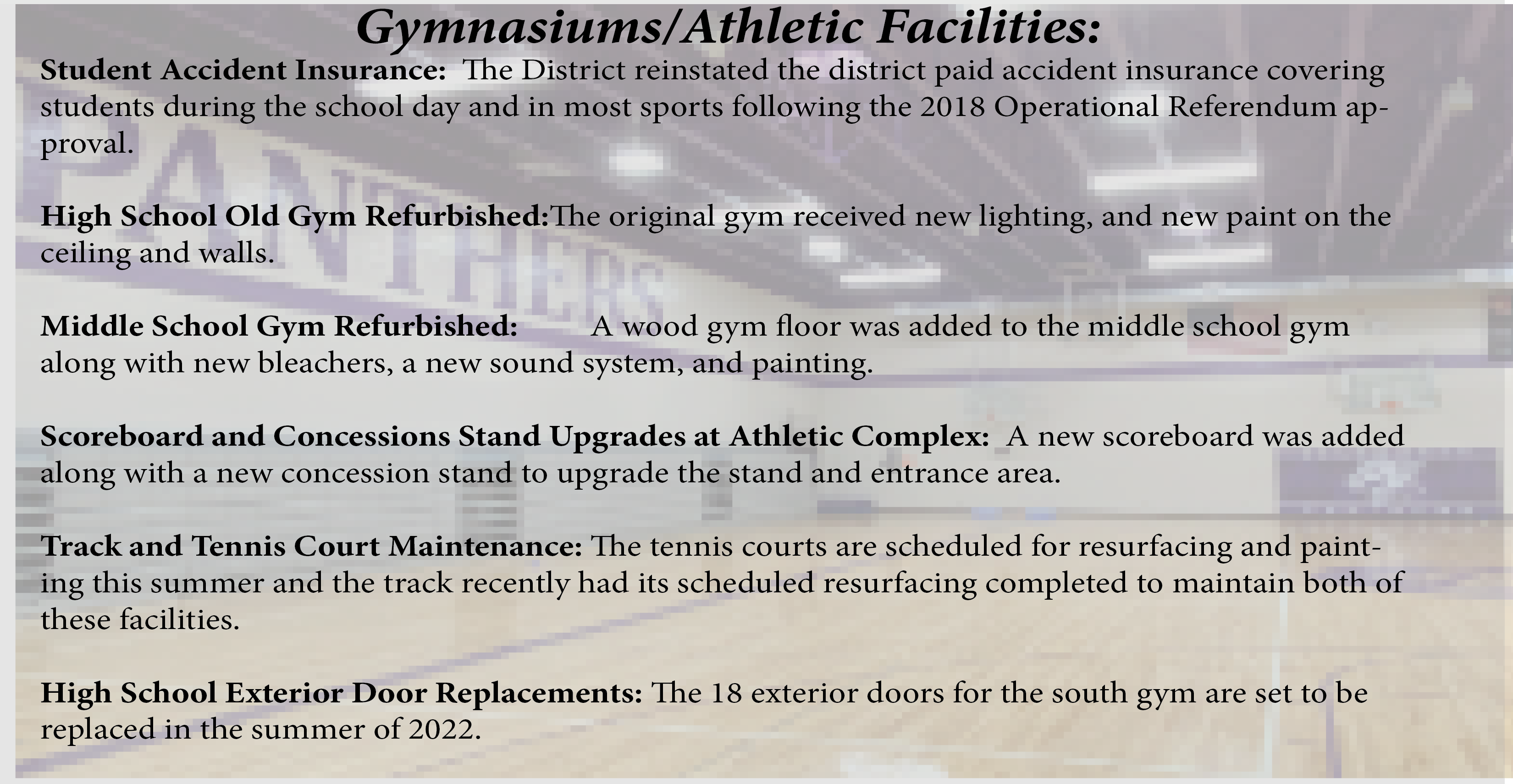

The listing provided demonstrates a number of quality investments the district has been able to continue with the referendum dollars. This listing puts a face on the types of ongoing investments that will continue in order to maintain quality programming and facilities. Many of these are simply not possible without referendum dollars.

Why Does the School District Need to Go to Referendum?

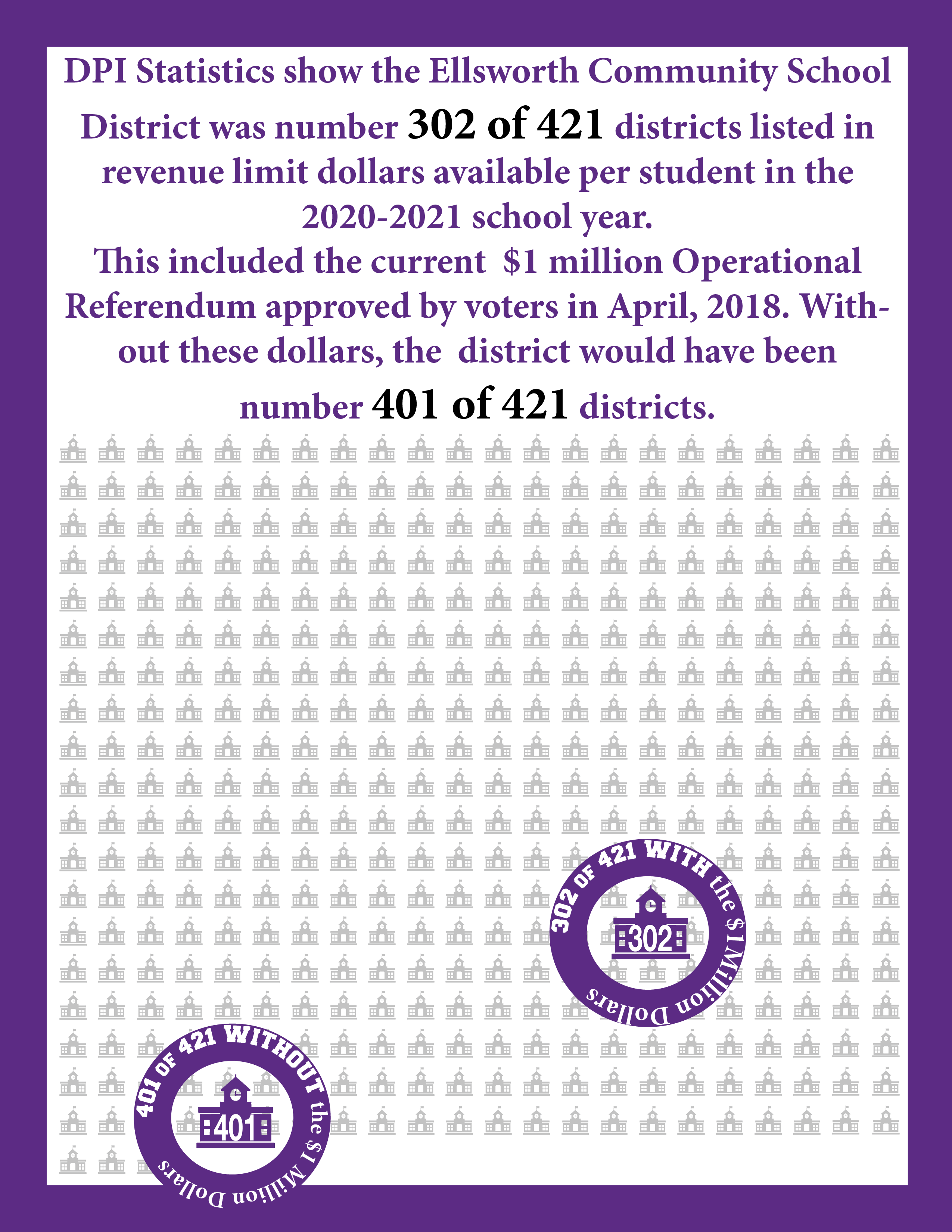

A fundamental element of the educational funding system in Wisconsin is the “revenue limit”. The system of revenue limits was put in place in 1993 and were based on the revenues of each district at that time. As a low spending district, our district along with a number of other districts, were imposed with revenue limits well below the state average. This system has continued to widen between low and high-revenue districts since that time.

As needs increase related to educational programming, co-curricular activities, technology improvements and facilities maintenance, low revenue districts must either cut costs or request additional funds through property taxes at the local level. On a yearly basis, many districts across the state offer Operational Referendums to address this need.

Are Operational Referendums Common?

Operational Referendums are quite common for Wisconsin School Districts. According to the Wisconsin Department of Public Instruction Website, the upcoming April 5th Election will see 48 Operational Referendums across the state.

In the 2020-2021 school year there were 65 Operational referendums held with 47 of the 65 being successful while 69 of the 97 Operational Referendums held in the 2019-2020 school year were successful.

Referendum Dollars Provide for Local Schools

Referendum dollars provide for the many programs and operational expenses at the local level. Rather than the state collecting property taxes and reallocating them across all school districts, an Operational Referendum allows voters to approve property taxes for use every day in their local schools.